Identify stress early. Engage with empathy. Prevent debt before it grows.

Identify stress early. Engage with empathy. Prevent debt before it grows.

How early identification of financial stress reduces cost, risk, and customer harm

When utilities understand early signs of financial stress, the first engagement can change the trajectory before debt escalates.

Every customer leaves a pattern. We help you interpret it — and act with empathy.

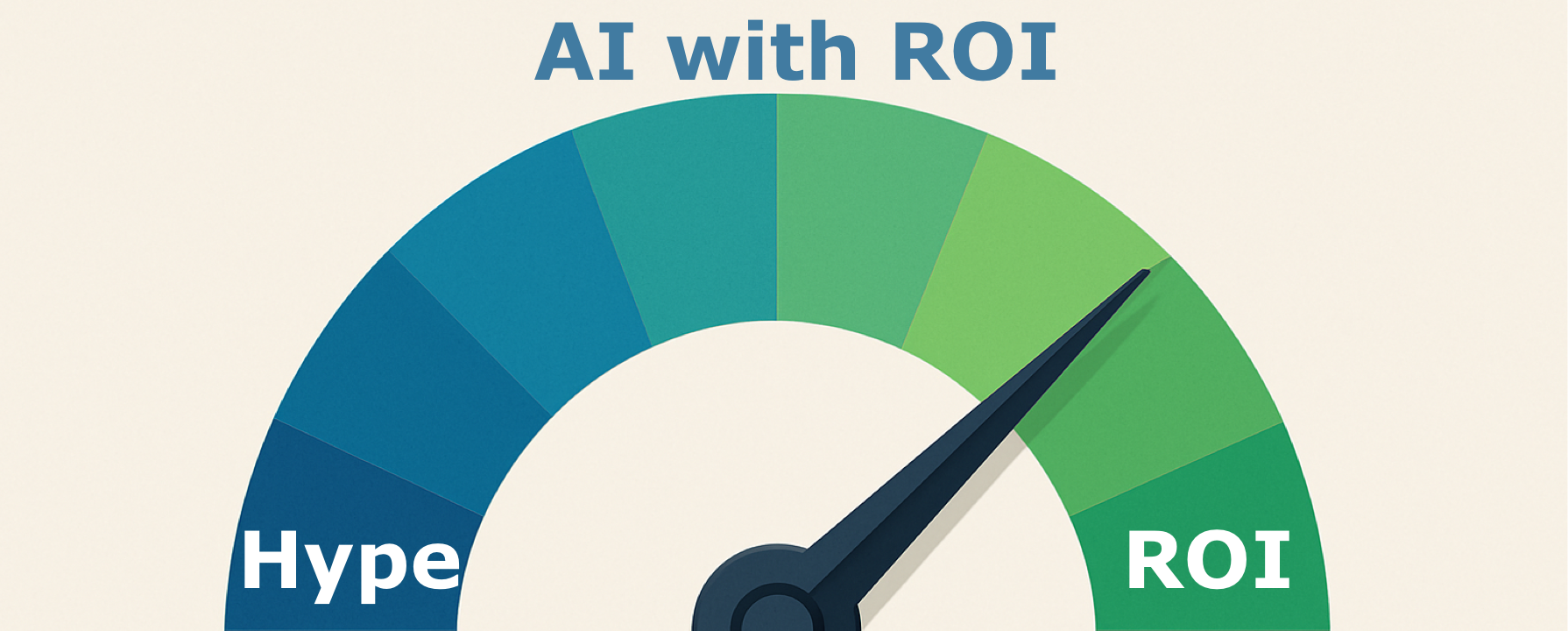

Article 4, The real power of AI lies in proving it works, week after week.

Article 3, It’s the conversation no one in AI really wants to have.

Article 2, Define success first — that’s how AI delivers outcomes

Article 1, from hype to proof: How to make AI deliver measurable ROI in the real world

From hype to proof: how to make AI deliver measurable ROI in the real world

The earliest signs of debt aren’t financial at all — they’re behavioural

From messy AI projects to measurable impact.

It’s not just about comms, it’s about context

Improve Financial Results & Strengthen Customer Relationships

The tools we rely on? They’re firing too late to make a real difference.

Discover how to identify struggling households early, reducing debt and enhancing customer outcomes.

AI now shapes, not just predicts, customer behaviour and outcomes

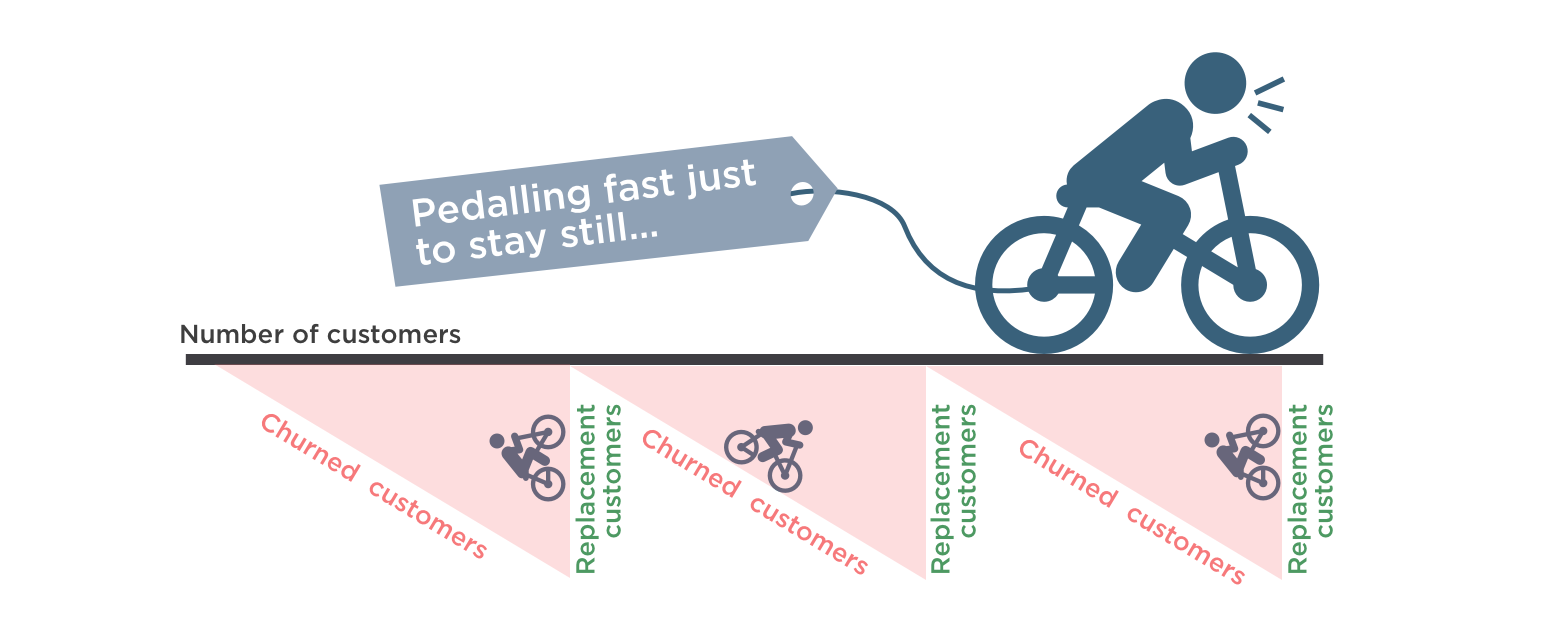

Customer Churn Reduction: Your Hidden Growth Strategy

It was inspiring to see such a strong focus on supporting vulnerable customers and driving meaningful change.

AI is creating a buzz across industries, and its potential for retail energy providers (REPs) is immense.

EMC21 is the largest Retail Energy Conference in North America. The theme for March 2024 is Mitigating Risk in Retail Energy.

There is a “golden window” of opportunity to identify potential future debt early and step in to help before emotions become heated.

Early intervention delivers a win-win for the energy retailer and the customer.

Are you looking to take your CX and marketing strategies to the next level?

Read the Top 7 insights from Customer Smarts podcaster Justin Stafford’s interview with SmartMeasures cofounder.

SmartMeasures helps energy retailers reach out to assist consumers who are having difficulty with energy bills.

AI powered by customer data and behavioural science helps you retain customers.

Are your CX metrics predicting actual retention behaviours to drive your retention strategy, or ‘aspirational’ indicators likely missing the mark?

CX executives use traditional metrics to report the performance of marketing initiatives — but are these the numbers the CEO wants?

When there is high churn, a lot of effort is spent winning lost customers back, but is that the right approach?

The average customer doesn’t exist. Learn how to use prediction to improve the ROI on your retention activity.

Happy customers make a business thrive, unhappy customers can bring down a business. It’s critical to understand your customers’ health.

Customer retention is the best strategy to deliver business growth and it’s lower cost focusing purely on customer acquisition strategies.

Hear the story behind SmartMeasures from the founders

Discover how you can implement your own solution to retain customers at Enlit Melbourne 16-17 March

In developing AI applications, objectives and intentions must be well communicated to the business and to users to earn trust.

Energy retailers who provide proactive customer experience can greatly improve customer retention rates.

To grow their business energy retailers need to be able to retain their existing customers.

Retail energy providers collect and store a tremendous amount of data about their customers.

Energy retailers need to change their game if they are to maintain profitability and grow their business.

Surveys only capture customer sentiment at a point in time and NPS doesn’t help you improve!