The average customer doesn’t exist. Learn how to use prediction to improve the ROI on your retention activity.

Companies want to predict which customers are likely to churn so they can implement strategies to prevent it.

The old way: Segmentation and propensity modelling

Most churn prediction is currently performed by using churn propensity models expressed as a percentage figure of how many customers are likely to leave for a given period of time.

Propensity models are calculated for different customer segments determined by demographics, which products customers are using, customer profitability and reasons for churning. A profile or avatar of the typical customer is constructed to represent each customer segment.

These models analyse the reasons for churn by segment and apply treatment strategies, accordingly, based on those segments. The same treatment strategy ends up being applied to all customers in a segment, whether they are likely to churn or not, causing a number of significant problems and challenges.

Examining churn rates by customer segment may highlight what types of customers are at risk and general information about the causes. It doesn’t, however, identify when an individual customer is about to churn or the particular issues that need to be addressed for that customer.

Old results: The average customer doesn’t exist

Offers and treatment strategies created to meet the needs of an avatar or some generic profile of a customer segment are not effective. In fact, retention efforts broadly applied to a segment, without recognising differences between individual customers, can be the cause for a customer churning. For instance, a retention offer may remind a customer about the imminent expiration of a contractual agreement and cause churn as a result.

Applying treatment strategies to entire customer segments, due to the large number of customers potentially involved, may be prohibitive due to costs. Calling 50,000 customers with an offer of a $50 voucher will cost millions. The cost to retain may very well be greater than the value of losing the customers that will churn. Most of the customers being contacted with the voucher or discount offer are unlikely to need it

It’s not that segmentation and propensity are completely redundant or futile exercises. They can help identify the most profitable types of customers, the general causes of churn for each customer segment and assist in the development of treatment strategies. But something more is needed to analyse the churn risk of each individual customer.

New way: Using AI for hyper-personalised churn prediction and retention

Organisations collect and store vast amounts of data about their customers. Advanced data analytics based on AI and machine learning can predict which customers, at an individual level, are at risk of churning. How it works is that each individual customer, based on the data, is given a risk score that highlights the ‘high risk’ factors for that customer.

AI powered churn analytics not only provides early warning about which customers are most at risk of churning, it allows for each customer to be engaged with a personalised treatment plan. A full picture of each customer’s circumstances can be seen. Every customer engagement becomes contextualised and personalised for each individual customer and can be delivered at scale.

New results: Accurate predictions and greater ROI

AI powered churn analytics allows a level of hyper-personalisation to happen at scale across multiple channels. Even corporates with millions of customers can give their customer service teams the ability to treat every customer as an individual. Regardless of the channel (phone, email, social media, live chat, etc) each customer is given the same level of personalised and positive service.

Treatment strategies and retention offers only need to be applied to the customers most at risk of churning, potentially saving the organisation millions of dollars. Being hyper-personalised the effectiveness of retention offers are far more effective compared to a more ‘scatter gun’ approach.

UUI (Useful Unique Insight)

Churn propensity models are largely an academic exercise and if you want to improve your ROI on retention activity, use churn prediction to retain customers.

Evidence

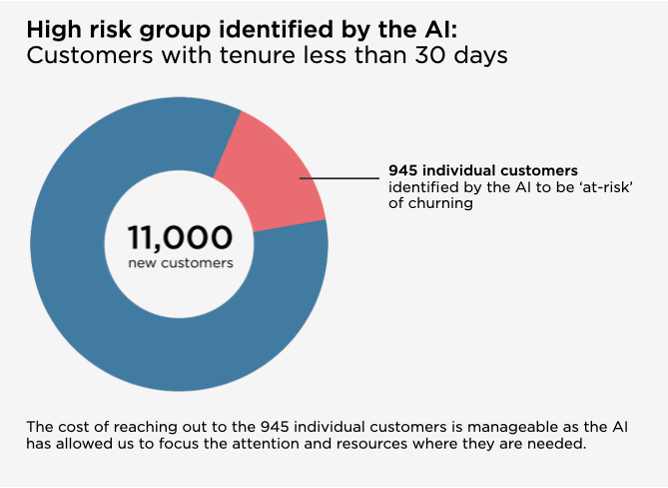

SmartMeasures recently ran a churn prediction project for an energy retailer. The energy retailer identified that a very ‘high risk’ group for churn was new customers. It would be too expensive to contact all new customers, so using SmartMeasures AI based churn analytics engine the energy retailer identified 945 out of 11,000 new customers as ‘at-risk’ customers. The energy retailer used their ‘white glove’ onboarding process to welcome these ‘at-risk’ customers.

The team at SmartMeasures are helping businesses accurately identify customers in need of support to help you focus your resources where they return you the best ROI.

If you would like to know more, get in touch.