AI powered by customer data and behavioural science helps you retain customers.

AI powered by customer data and behavioural science helps you retain customers.

Are your CX metrics predicting actual retention behaviours to drive your retention strategy, or ‘aspirational’ indicators likely missing the mark?

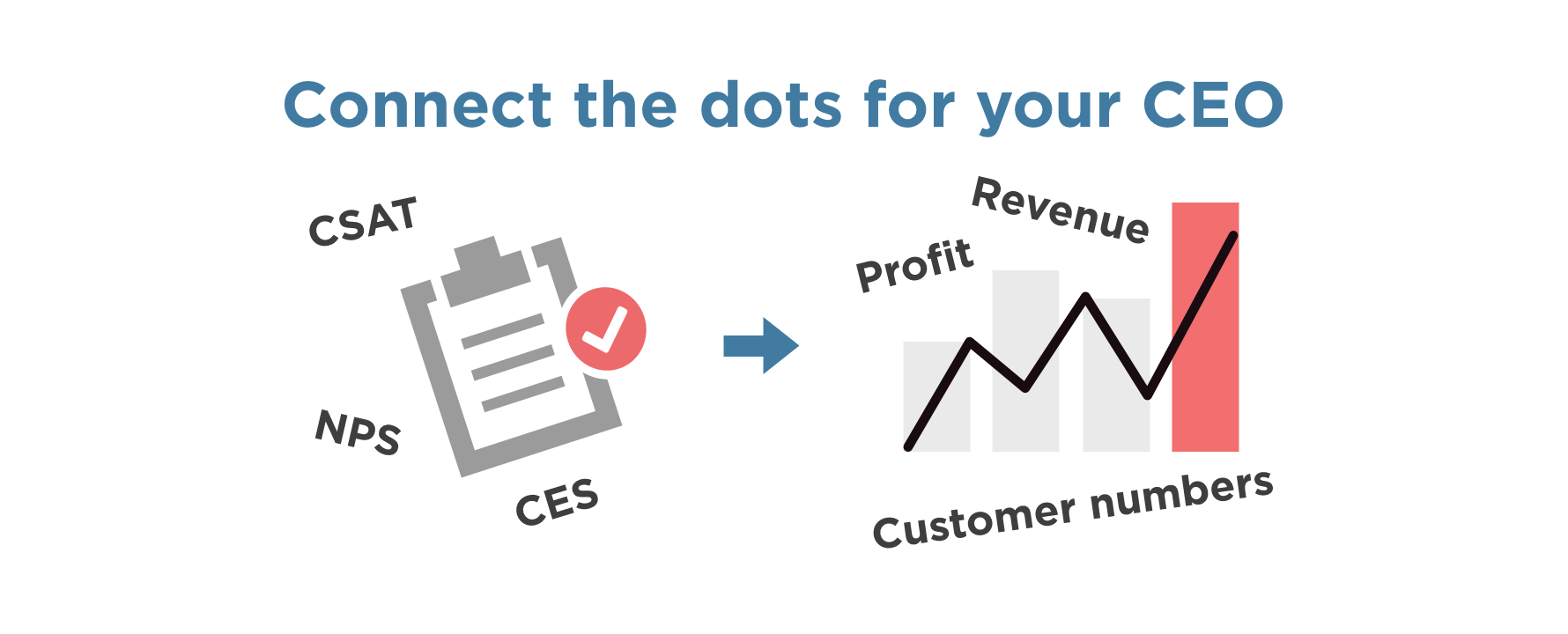

CX executives use traditional metrics to report the performance of marketing initiatives — but are these the numbers the CEO wants?

Customer retention is the best strategy to deliver business growth and it’s lower cost focusing purely on customer acquisition strategies.

Happy customers are cheaper to service, less price sensitive and less likely to churn. Customer happiness goes beyond customer satisfaction by creating an emotional connection with a brand’s products and services. The challenge lies in understanding what makes customers happy and how much value this brings to the business?

Most organisations have developed extensive surveys and tools to analyse and assess customer satisfaction. CSAT and NPS provide time tested metrics for assessing satisfaction from customers willing to participate in a survey. CSAT surveys typically ask customers to rate experiences by the following criteria:

But customer happiness is very different to customer satisfaction. The ability to define and measure happiness is far more challenging, though the potential benefits far exceed the benefits gained from customers who are merely satisfied.

The difference between satisfaction and happiness

Customer satisfaction implies that customers feel ok about their experiences with a brand. It’s an emotionally neutral state where customers’ expectations are being met. Satisfaction does not mean there is an emotional connection with the brand or its products and services

An article from Gallup highlights how satisfying customers without creating an emotional connection has no real value. For satisfaction without an emotional connection has no impact on loyalty or churn reduction. A customer may be satisfied with the last interaction they had with a company but would readily switch to a competitor for a better deal.

Creating an emotional connection

Cliff Condon from Forrester comments, “If brands want to break away from the pack and become CX leaders, they must focus on emotion. Best-in-class brands average 17 emotionally positive experiences for every negative experience, while the lowest-performing brands provided only two emotionally positive experiences for each negative one. Emotion is critical to a brand’s bottom line.”

To establish an emotional connection between a customer and the brand, means designing customer experiences that tap into emotional motivators such as a desire to feel a sense of belonging, to succeed in life, or to feel secure. So customers are not just satisfied with a transaction or an experience, but that sense of satisfaction is matched with a deeper emotional connection.

The benefits

It’s happiness not satisfaction that drives customer loyalty and engagement as well as the propensity for customers to recommend the brand to others. Research published in HBR demonstrates that emotionally connected customers are more than twice as valuable as very satisfied customers.

Emotionally connected customers will buy more products and services, be less price sensitive and recommend the brand and its products to others. In 2018 research from Adobe found repeat customers:

Other statistics include:

The statistics are compelling. Maximising customer happiness is a powerful means for maximising customer value.

In your family, friendship circle, amongst work colleagues, apologies are part of what maintains trust. It seems common sense that if you let someone down or fail to deliver what you have promised, you need to apologise. This applies just as much to a brand and its customers as to our private relationships with friends and family.

Customer satisfaction surveys and exit surveys

How far can an apology reverse the damage done and help retain disgruntled customers?

The economics of an apology

A field experiment conducted in September 2018 on 1.5million Uber customers who had experienced late rides suggested there was a financial impact. Their analysis found that “absent any apology, a rider who experienced a late trip spends 5-10% less on the platform than can otherwise be expected.”

Apologies matter. They have an impact on customer retention and future spend. People are more than likely to forgive a company that says sorry. A financial incentive may help sweeten the deal, but in many cases that may not be necessary. An apology recognises the pain or frustration the customer has felt. If the pain felt is minor, financial compensation is most properly unnecessary.

But an apology is also a promise that things in the future will be better. If the customer continues to experience the same problem, they will become far less forgiving after each incident.

The Uber field experiment highlighted the following insights:

When customers enter into a commercial arrangement they are trusting the business to deliver on their promise. When something goes wrong, an apology can restore trust. The absence of an apology can message:

There is a saying in large organisations “Don’t poke the bear”. We hope the customer hasn’t noticed we have stuffed up. The fear is that if we admit our mistake and reach out to service the customer, it will be the catalyst for them to leave us.

But if we don’t apologise, in psychological terms, what message does it send to the customer? It says either we hadn’t realised we failed them, or that we didn’t care and they’re not that important to us.

This fits with the Forbes study that says 68% of all people leave a business because of a perceived indifference. Could this be related to a poor service experience and no recognition, apology or compensation?

With technology now, most large businesses can detect when something goes wrong for individual customers.

Apologies, to be truly effective and not simply saying sorry, are often difficult. An apology is due when trust is broken, and to restore trust the apology is the first step. No apology increases the potential of losing a customer. The apology is a promise that a problem will be rectified and will not happen again. If you fail to deliver on that promise than the consequences are likely to be more costly than if you never apologised in the first place.

Customer churn, sometimes called attrition, is when a customer switches to another supplier.

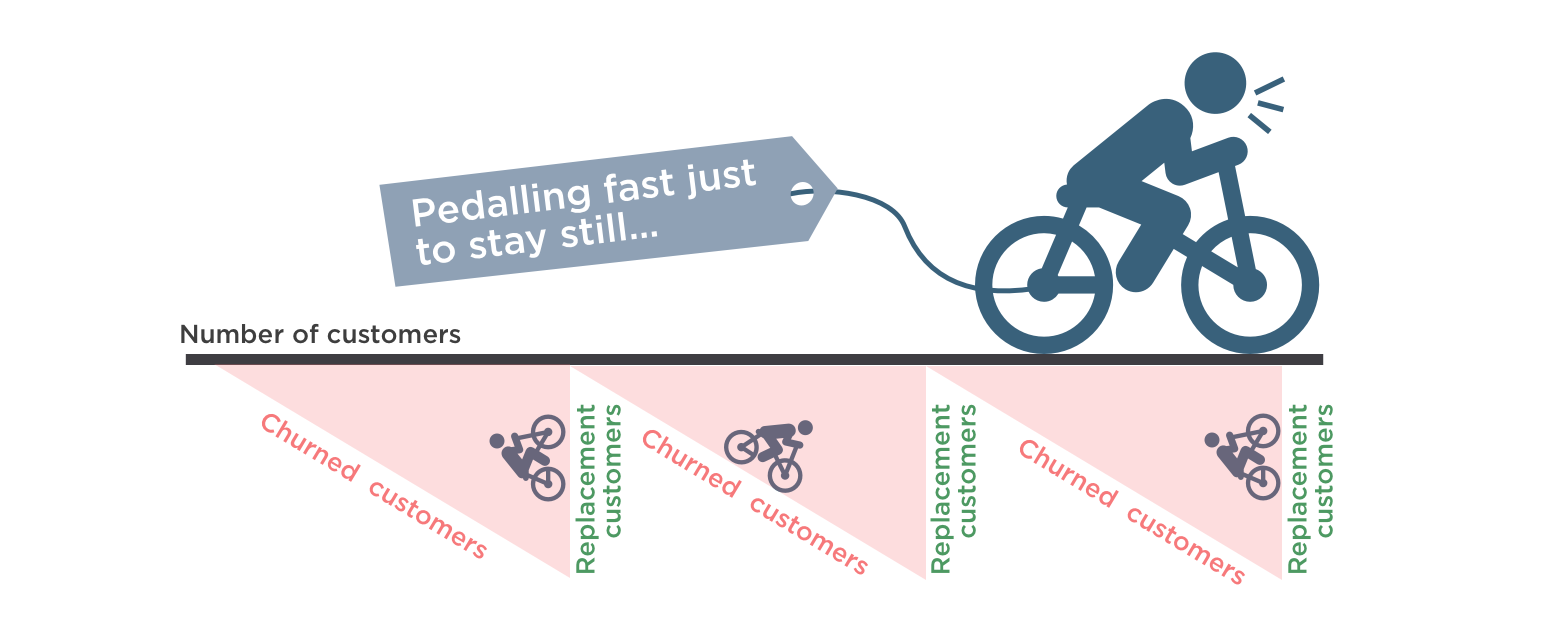

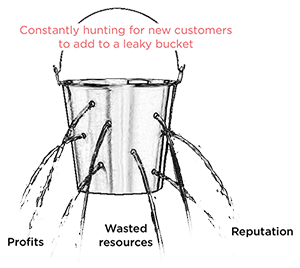

Let’s face it, times are tough for businesses, particularly energy retailers. Retail margins are under pressure, they are at the end of the supply chain and carry the high cost of customer churn.

While competition is a good thing, constant churn between providers is significantly detrimental to profitability and reputation.

There are a couple of misconceptions about customer churn:

Price alone drives customers to leave

If it’s not about price, then why do customers leave?

Forbes says that 68% of all people leave a business, because of ‘perceived indifference’.

While Bain & Co says a customer is 4 times more likely to defect to a competitor if the problem is service related than price or product related.

If we reflect on our own experiences and feelings as customers to large suppliers. We can probably relate to both these statements. As humans, we relate to being understood and appreciated and if we feel that we are being serviced too, then we are not even likely to entertain a conversation with a new supplier, let alone actually churn.

If we feel our supplier is looking after us, we stay, even at a price premium. Who wants the hassle of moving suppliers?

Now if we get an exceptional offer from another supplier at a good price, and we are unhappy with our current supplier, then we might consider switching if the price is attractive.

So, businesses need to focus on making us feel appreciated and on service, rather than on price. More on this later.

It’s too costly to try to keep customers.

We often hear – “It’s cheaper to let them go and replace them with new ones.”

HBR says “Acquiring a new customer is anywhere between 5 and 25 more expensive than retaining an existing one”

The truth is, the main focus on retention is when a customer has already decided to leave, and are in the process of changing suppliers. The existing supplier will often then attempt to win us back with an offer of a lower price and usually a gift or voucher to entice us to stay.

The cost of this retention activity, so late in the game, is high, and if it retains the customer there is usually some ill-will created. Why wasn’t I offered this price before now? It took someone else to pay attention to me for my existing supplier to notice me.

Retention effort at this late stage is expensive and doesn’t always work.

The trick is to be pro-active and get in early with service because it’s cheaper and more effective at retaining the customer.

Large businesses often have huge numbers of customers and it’s hard to see who is in need of service attention. So what should a business look out for? What factors reflect or impact customer sentiment?

There are 3 groups of data which, when combined, are quite effective at predicting customer churn:

Prediction

There is a lot of data across many systems and it’s constantly changing. What’s the best way to monitor the situation for every customer and predict when to take action to service those in need in real-time?

Most large businesses have data analytics programs to leverage their data to gain insights to take action. But is this may not be the best approach for churn prediction.

An alternative approach is presented in a recent HBR article – Alibaba and the Future of Business. This new approach has been labelled “Smart Business” and proposes running a continuous process of collecting data, analysing, learning and taking action in real-time.

In this example, for measuring individual customer health and predicting churn, the AI does the discovery and takes action based on findings. Historical data is collected to train the AI to predict customer sentiment and churn risk, then Operational, Behavioural and External data is collected real time to continuously assess the risk for every customer.

The AI alerts the business to when customers are ‘at-risk’ of churning and a Treatment Plan is initiated automatically to reach out to service the customer.

The Treatment Plans are designed in conjunction with the customer service team to ensure effectiveness and are optimised to ensure the cost of treatment is minimised and well below the replacement cost for that customer.

When an ‘at-risk’ customer is treated, the results are fed back into the AI to continuously learn and optimise costs.

The objective with a solution like this is to leverage all that existing data for the good of the customer AND for growing the business’s revenue.

Just imagine a business knowing their customers at an individual level, knowing if they’re happy or not. And if they’re not, knowing they have the systems in place to reach out and service individual customers BEFORE they think about leaving.

At SmartMeasures, we have built a software solution that does all this.

If this is something you would like to hear more about, please message me.

Libby Dale

Co-founder, SmartMeasures

[email protected]

+61400 633 729