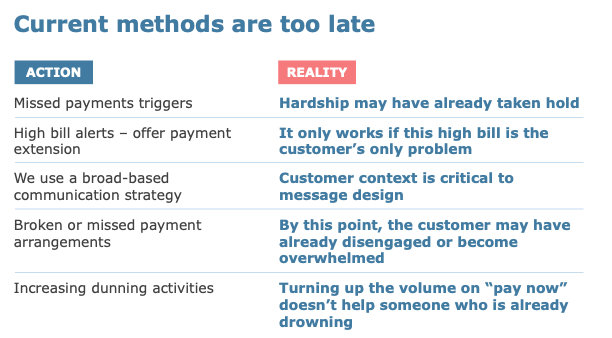

The tools we rely on? They’re firing too late to make a real difference.

For too long, we’ve relied on the same tired signals to tell us when a customer is in financial trouble—missed payments, broken payment arrangements, and high bills. The problem is, by the time these red flags appear, the hardship has already taken hold. The debt is already growing and the customer may already be shutting down.

And when we act too late, the options to help are fewer, the cost is higher, and trust is harder to rebuild.

What we know about early-stage financial stress

When we detect financial stress early—really early—outcomes improve dramatically for everyone involved. Debts are smaller. Customers are more engaged. Recovery is faster. And trust in the retailer or utility is preserved.

But early stress doesn’t look like a missed payment. It looks like someone who’s still paying, but starting to fall behind in other areas of life. Someone who’s keeping their bill in the “to do” pile a little longer than usual. Who’s skipping essentials. Who’s anxious, ashamed, and often paralysed by the idea of asking for help.

Because here’s the thing: financial stress rarely makes people proactive. It makes them hide.

That means waiting for a missed payment is a reactive strategy. It’s showing up after the crisis has hit. It’s too late.

Why the current methods aren’t working

Let’s take a quick look at the most common tools used today—and why they often fail to deliver real impact.

Missed payment triggers

This is the traditional tripwire. But by the time a customer has missed a payment, they may have already gone through months of silent struggle. A missed payment isn’t the beginning of the problem. It’s the tipping point—too late for prevention, and often too late for trust.

High bill alerts with payment extensions

Helpful if the issue is a one-off spike in usage. But for customers already under financial strain, this only delays the inevitable. These alerts aren’t part of a true energy debt prevention program—they’re Band-Aids on a deeper issue.

Generic communications

Mass emails or broad campaigns about “support if you need it” often fall flat. Customers in hardship don’t respond to generic noise—they need customer hardship support strategies that speak directly to them.

Broken or missed payment arrangements

When a customer can’t stick to a plan, it’s usually not about unwillingness. It’s about being overwhelmed. To make a difference, we need tools to support vulnerable customers, not just more plans.

Increased dunning activity

More payment reminders don’t work when the barrier is stress, not forgetfulness. Collections need a re-think—a shift toward collections innovation in energy, not just more of the same.

So where do we go from here?

We need to get smarter—and more human—about how we approach financial stress.

That starts with recognising that early-stage hardship doesn’t show up in the obvious places. The signs are subtle and often buried in operational data. A change in digital behaviour. A skipped interaction. A new pattern in usage. These are the signals that matter—and spotting them is the key to how to identify financial hardship early.

That’s where AI comes in.

AI solutions for collections teams are now uncovering early signs of financial stress with precision—surfacing risk based on subtle, real-time behavioural insights. These aren’t credit scores or financial histories—they’re dynamic signals that help you reach the right people at the right time.

This is the power of new technologies for customer arrears. They allow you to shift from reactive collections to proactive collections strategies for energy retailers. And once you identify who’s at risk? That’s when the real work begins—delivering energy customer support automation that feels human, not robotic.

When support feels timely, relevant, and personal—everyone wins:

- Customers stay connected and feel understood

- Debt is prevented, not just managed

- Collections teams focus on recovery, not escalation

- Trust in your brand grows stronger

It’s not just about how to reduce energy customer debt. It’s about preventing it in the first place.

A change in mindset

This shift toward early intervention for customer arrears isn’t just a new tactic—it’s a new mindset. One where collections process improvement is built on care, not crisis. Where we stop waiting for customers to fail, and start acting on their behalf before they fall.

At SmartMeasures, we’ve built our solution around this principle. Using predictive AI to detect early financial stress. Using behavioural science to design messages that change outcomes. And delivering it all as a managed service—so you get the benefit without the complexity.

If you’re ready to explore best practices for managing customer debt, we’re here to help.

We’re always up for a conversation with others who want to do early intervention differently. If you’re thinking about smarter, earlier, more effective support—we’d love to talk, get in touch.