Category: blog

Why CX is stagnating

Unhappy customers – what’s the cost?

What’s the difference between a dissatisfied customer and an unhappy or angry customer?

A dissatisfied customer is likely to feel frustrated or annoyed about an aspect of your service. Service delivery may have been a bit slow. Or a minor mistake was made. The incident may be quickly resolved and soon forgotten. An unhappy customer, however, will not be easily placated. They have the potential to do real damage to your brand.

As with the difference between a satisfied and happy customer, it’s about the emotional connection. Just as an emotionally engaged and happy customer is a great benefit to your business, unhappy customers are a threat to your business. They will vent their dissatisfaction to friends and family. Leave damning reviews on social media and forums.

Not only will you lose their business. You will lose the business from other potential customers.

Dissatisfied versus unhappy or angry customers

An unhappy or dissatisfied customer have one thing in common – they are both bad for your business. Dissatisfied customers will be more passive. Their feelings are less intense and short lived. They are unlikely to complain or let you know they are dissatisfied. If they take any action it’s likely to be that they won’t use your products or services again. They may also tell a number of friends about their experience.

Angry customers will let you and the rest of the world know their feelings. They will leave angry one star reviews on Google and Facebook. They will take any opportunity they can to complain about your business and explain why you are hopeless.

From dissatisfaction to anger

Most dissatisfied customers can be handled with an apology and a commitment to rectify the mistake that was made. However, if the same problem, despite the apologies, keeps happening, the minor feelings of annoyance or frustration will deepen. Instead of extreme dissatisfaction, customers will start feeling betrayed by the business from promises constantly being broken.

Feelings of betrayal will turn to anger. Angry Customers will respond strongly and in many cases seek to punish the business.

The costs

The costs to a business from dissatisfied customers is enormous. Research shows a typical business hears from just 4 percent of its dissatisfied customers—and of those 96 percent who never voice complaints, 91 percent will never come back. According to research from Vision Critical businesses across the world are losing trillions of dollars due to dissatisfied and unhappy customers.

It’s not possible to keep every customer constantly happy and satisfied. Mistakes will happen. Miscommunications will happen. It’s how you handle those mistakes and how well you keep the promises you make to customers that will make them happy or make them feel betrayed.

The Value of Happy Customers

Happy customers are cheaper to service, less price sensitive and less likely to churn. Customer happiness goes beyond customer satisfaction by creating an emotional connection with a brand’s products and services. The challenge lies in understanding what makes customers happy and how much value this brings to the business?

Most organisations have developed extensive surveys and tools to analyse and assess customer satisfaction. CSAT and NPS provide time tested metrics for assessing satisfaction from customers willing to participate in a survey. CSAT surveys typically ask customers to rate experiences by the following criteria:

- Very satisfied

- Somewhat satisfied

- Neutral

- Somewhat dissatisfied

- Very dissatisfied

But customer happiness is very different to customer satisfaction. The ability to define and measure happiness is far more challenging, though the potential benefits far exceed the benefits gained from customers who are merely satisfied.

The difference between satisfaction and happiness

Customer satisfaction implies that customers feel ok about their experiences with a brand. It’s an emotionally neutral state where customers’ expectations are being met. Satisfaction does not mean there is an emotional connection with the brand or its products and services

An article from Gallup highlights how satisfying customers without creating an emotional connection has no real value. For satisfaction without an emotional connection has no impact on loyalty or churn reduction. A customer may be satisfied with the last interaction they had with a company but would readily switch to a competitor for a better deal.

Creating an emotional connection

Cliff Condon from Forrester comments, “If brands want to break away from the pack and become CX leaders, they must focus on emotion. Best-in-class brands average 17 emotionally positive experiences for every negative experience, while the lowest-performing brands provided only two emotionally positive experiences for each negative one. Emotion is critical to a brand’s bottom line.”

To establish an emotional connection between a customer and the brand, means designing customer experiences that tap into emotional motivators such as a desire to feel a sense of belonging, to succeed in life, or to feel secure. So customers are not just satisfied with a transaction or an experience, but that sense of satisfaction is matched with a deeper emotional connection.

The benefits

It’s happiness not satisfaction that drives customer loyalty and engagement as well as the propensity for customers to recommend the brand to others. Research published in HBR demonstrates that emotionally connected customers are more than twice as valuable as very satisfied customers.

Emotionally connected customers will buy more products and services, be less price sensitive and recommend the brand and its products to others. In 2018 research from Adobe found repeat customers:

- Are buying nearly 30% more items per order than first-time shoppers

- Are 9 times more likely to convert than first-time shoppers

- Generated three to seven times more revenue per visit

Other statistics include:

- A 5% increase in customer retention correlates with at least a 25% increase in profit (Bain & Company)

- Customers with an emotional relationship with a brand have a 306% higher lifetime value and will recommend the company at a rate of 71%, rather than the average rate of 45%. (Motista).

The statistics are compelling. Maximising customer happiness is a powerful means for maximising customer value.

How AI can make you smarter

Does an apology help with customer retention?

In your family, friendship circle, amongst work colleagues, apologies are part of what maintains trust. It seems common sense that if you let someone down or fail to deliver what you have promised, you need to apologise. This applies just as much to a brand and its customers as to our private relationships with friends and family.

Customer satisfaction surveys and exit surveys

How far can an apology reverse the damage done and help retain disgruntled customers?

The economics of an apology

A field experiment conducted in September 2018 on 1.5million Uber customers who had experienced late rides suggested there was a financial impact. Their analysis found that “absent any apology, a rider who experienced a late trip spends 5-10% less on the platform than can otherwise be expected.”

Apologies matter. They have an impact on customer retention and future spend. People are more than likely to forgive a company that says sorry. A financial incentive may help sweeten the deal, but in many cases that may not be necessary. An apology recognises the pain or frustration the customer has felt. If the pain felt is minor, financial compensation is most properly unnecessary.

But an apology is also a promise that things in the future will be better. If the customer continues to experience the same problem, they will become far less forgiving after each incident.

The Uber field experiment highlighted the following insights:

- It depends on how

the apology is made. If it’s not managed

it may in fact backfire.

The logic is pretty simple: if you promise to improve, and then don’t, the apology is worth less than zero. If you overuse them, it can be worse than no apology. And in some cases, admitting you are wrong and apologising can seem like a weakness. - Money speaks louder than words – the best form of apology includes a discount or a voucher. In the Uber experiment, when they included a $5 coupon for a future trip, that actually worked to reverse some of the bad effects of a bad trip. To put it in perspective, a bad trip, the person spends 5% – 10% less on future trips. If you give them a $5 coupon, there was an increase of 2% in net spending.

- In some cases, sending an apology is worse than sending nothing at all, particularly for repeated apologies. Again, the logic is simple: an apology is basically making a promise. When we apologise we are basically accepting being held to a higher standard relative to somebody that did not apologise. When customers received multiple apologies, they found that these customers actually punished the company more than customers that never got an apology at all.

When customers enter into a commercial arrangement they are trusting the business to deliver on their promise. When something goes wrong, an apology can restore trust. The absence of an apology can message:

- we haven’t realised what we’ve done

- we don’t care, we are not committed to holding up our side of the bargain

- we are hoping the customer hasn’t noticed

There is a saying in large organisations “Don’t poke the bear”. We hope the customer hasn’t noticed we have stuffed up. The fear is that if we admit our mistake and reach out to service the customer, it will be the catalyst for them to leave us.

But if we don’t apologise, in psychological terms, what message does it send to the customer? It says either we hadn’t realised we failed them, or that we didn’t care and they’re not that important to us.

This fits with the Forbes study that says 68% of all people leave a business because of a perceived indifference. Could this be related to a poor service experience and no recognition, apology or compensation?

With technology now, most large businesses can detect when something goes wrong for individual customers.

Apologies, to be truly effective and not simply saying sorry, are often difficult. An apology is due when trust is broken, and to restore trust the apology is the first step. No apology increases the potential of losing a customer. The apology is a promise that a problem will be rectified and will not happen again. If you fail to deliver on that promise than the consequences are likely to be more costly than if you never apologised in the first place.

Turning the tide on churn with AI, big data and your service team

Customer churn, sometimes called attrition, is when a customer switches to another supplier.

Let’s face it, times are tough for businesses, particularly energy retailers. Retail margins are under pressure, they are at the end of the supply chain and carry the high cost of customer churn.

While competition is a good thing, constant churn between providers is significantly detrimental to profitability and reputation.

There are a couple of misconceptions about customer churn:

- Price alone drives customers to leave

- It’s too costly to try to keep customers. It’s cheaper to let them go and replace them with new ones

Price alone drives customers to leave

If it’s not about price, then why do customers leave?

Forbes says that 68% of all people leave a business, because of ‘perceived indifference’.

While Bain & Co says a customer is 4 times more likely to defect to a competitor if the problem is service related than price or product related.

If we reflect on our own experiences and feelings as customers to large suppliers. We can probably relate to both these statements. As humans, we relate to being understood and appreciated and if we feel that we are being serviced too, then we are not even likely to entertain a conversation with a new supplier, let alone actually churn.

If we feel our supplier is looking after us, we stay, even at a price premium. Who wants the hassle of moving suppliers?

Now if we get an exceptional offer from another supplier at a good price, and we are unhappy with our current supplier, then we might consider switching if the price is attractive.

So, businesses need to focus on making us feel appreciated and on service, rather than on price. More on this later.

It’s too costly to try to keep customers.

We often hear – “It’s cheaper to let them go and replace them with new ones.”

HBR says “Acquiring a new customer is anywhere between 5 and 25 more expensive than retaining an existing one”

The truth is, the main focus on retention is when a customer has already decided to leave, and are in the process of changing suppliers. The existing supplier will often then attempt to win us back with an offer of a lower price and usually a gift or voucher to entice us to stay.

The cost of this retention activity, so late in the game, is high, and if it retains the customer there is usually some ill-will created. Why wasn’t I offered this price before now? It took someone else to pay attention to me for my existing supplier to notice me.

Retention effort at this late stage is expensive and doesn’t always work.

The trick is to be pro-active and get in early with service because it’s cheaper and more effective at retaining the customer.

Large businesses often have huge numbers of customers and it’s hard to see who is in need of service attention. So what should a business look out for? What factors reflect or impact customer sentiment?

There are 3 groups of data which, when combined, are quite effective at predicting customer churn:

- Operational data – how the business is delivering for its customers

- Behavioural data – what actions customers are taking that might give us a measure of how they are feeling (their sentiment)

- External data – There are external data sources that could provide an early indicator that a customer may consider looking around

Prediction

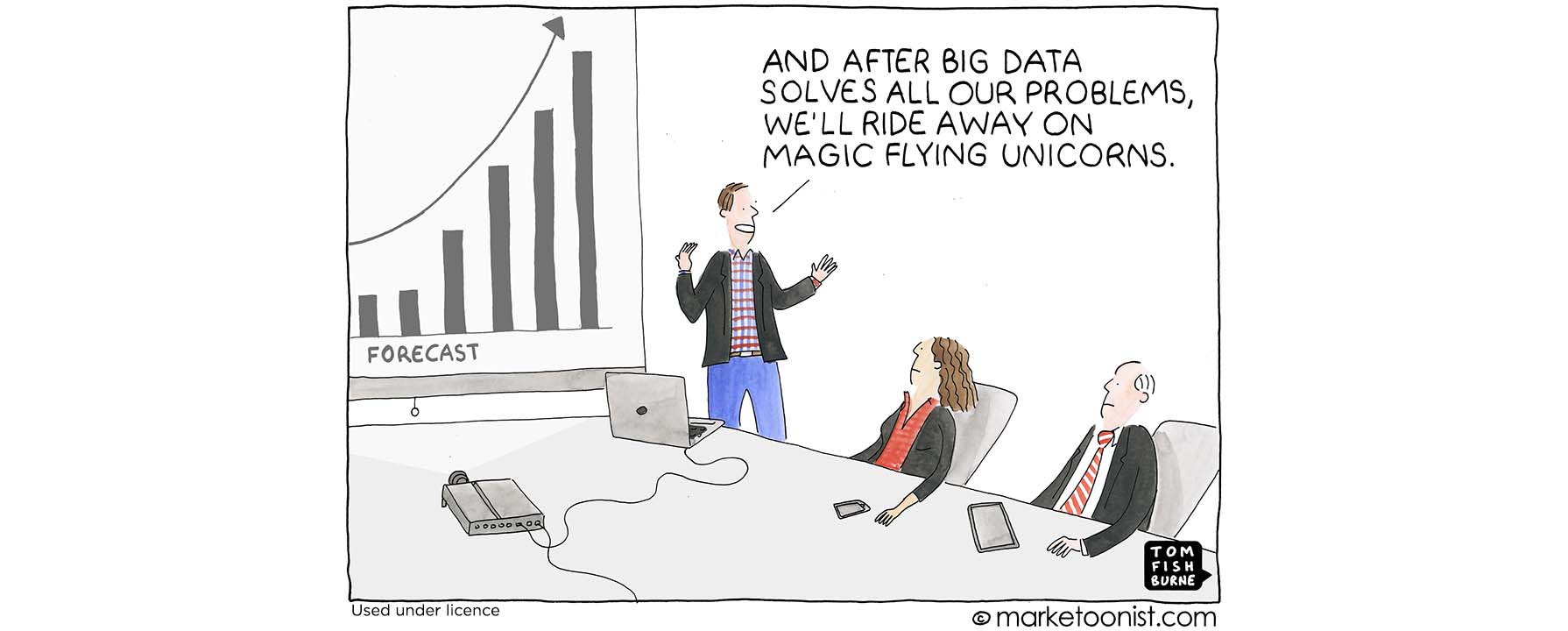

There is a lot of data across many systems and it’s constantly changing. What’s the best way to monitor the situation for every customer and predict when to take action to service those in need in real-time?

Most large businesses have data analytics programs to leverage their data to gain insights to take action. But is this may not be the best approach for churn prediction.

An alternative approach is presented in a recent HBR article – Alibaba and the Future of Business. This new approach has been labelled “Smart Business” and proposes running a continuous process of collecting data, analysing, learning and taking action in real-time.

In this example, for measuring individual customer health and predicting churn, the AI does the discovery and takes action based on findings. Historical data is collected to train the AI to predict customer sentiment and churn risk, then Operational, Behavioural and External data is collected real time to continuously assess the risk for every customer.

The AI alerts the business to when customers are ‘at-risk’ of churning and a Treatment Plan is initiated automatically to reach out to service the customer.

The Treatment Plans are designed in conjunction with the customer service team to ensure effectiveness and are optimised to ensure the cost of treatment is minimised and well below the replacement cost for that customer.

When an ‘at-risk’ customer is treated, the results are fed back into the AI to continuously learn and optimise costs.

The objective with a solution like this is to leverage all that existing data for the good of the customer AND for growing the business’s revenue.

Just imagine a business knowing their customers at an individual level, knowing if they’re happy or not. And if they’re not, knowing they have the systems in place to reach out and service individual customers BEFORE they think about leaving.

At SmartMeasures, we have built a software solution that does all this.

If this is something you would like to hear more about, please message me.

Libby Dale

Co-founder, SmartMeasures

[email protected]

+61400 633 729

A pragmatic approach to getting benefits from AI

In the enterprise world, data is never clean. Data is never complete. Data is never without errors and it is never all in the one place. Worse still, often the meaning of the data changes over time as business processes change or the systems that store the data are upgraded.

There is an age-old saying in the computer industry that goes: “Garbage in, garbage out” Or in other words, if you feed a computer data with issues, don’t expect an answer without issues.

All this does not bode well for AI, which likes to consume vast amounts of data.

Traditionally, the data science approach has been to prepare the data first – to plug the gaps and correct the data as much as possible so that you are comparing apples with apples.

I’d like to suggest a different mindset. A communication engineer’s view of the world is from the perspective of signal and noise. There will always be noise. The goal is to maximise the gain of the signal in the presence of noise.

So, rather than over-invest in data prep (particularly since the value of the data is uncertain in the early stages), instead prioritize AI approaches that:

- are resilient to noise and agnostic to the meaning of the data

- can start as a small pilot then quickly scale to your entire customer base

- continuously learn as your data changes

As we demonstrated to an Australian energy retailer recently for predicting customer churn, this approach can achieve unexpectedly high levels of prediction accuracy.

But prediction alone is not the answer.

A system that just predicts doesn’t deliver a business outcome. Instead you need two engines – one to constantly predict based on changing data and a second “treatment engine” to decide when and how to act or not-act on the prediction. Where is the cut-off point that maximises the benefit we receive? In the case of customer churn, how do I minimise the combined cost of either keeping my customers or replacing them? How do I maximise the total number of customers? Can my system learn from my attempts to reduce my churn?

These are some of the principles we hold dear in our software.

Predicting customer churn then stepping in to stop it…

Sounds like something from science fiction?

Conjures up scenes from the block-buster, Minority Report, where ‘pre-cogs’ predicted crimes before they happened and members of the ‘pre-crime’ squad arrested perpetrators before they even lifted a finger?

However, predicting churn before it happens is not the stuff of sci-fi. It is here with us today thanks to powers of artificial intelligence (AI) and the tenacity and determination of two Australian customer retention experts, Libby Dale and Mike Crooks, who have developed the world’s first churn predictive software applicable across industry.

Aptly called, SmartMeasures, this clever software enables businesses to accurately pinpoint if customers are on the verge of churn (or at the very least, are thinking about it) and to very quickly step in before an irritation or series of annoyances becomes a full-blown problem.

The new solution is riding on the back of a global trend focussed on retaining customers rather than accepting attrition as a normal but painful part of business. This, in turn, has spawned the emergence of a brand new practise area, ‘customer success management’.

Not surprisingly, says Ms Dale, SmartMeasures has the potential to save businesses millions of dollars in lost business.

“Conservatively speaking our software is capable of stripping 10 percent from our churn bill. By way of example, a company losing $500 million to customer attrition (which is commonplace in high-churn industries), can at the very least anticipate savings in the order of $20M per annum.

“Naturally our expectation is that it will save them much, much more.”

SmartMeasures is now available to English speaking businesses globally which has a churn problem costing them in excess of $10M annually. However, those with churn problems over $50M are likely to benefit most.

Rather than relying on the ‘pre-cogs’ of Minority Report to foresee pending attrition, the software relies on an exhaustive collection of customer risk markers or measures drawn from across business. These measures have the potential to contribute to changes in customer sentiment and can include negative customer behaviour such as not paying bills on time, declining product usage, complaints, calling the call centre on multiple occasions or impacts the business has on customers such as operational problems, late delivery, variable product quality, billing errors and so on.

When one of these markers or a mix of these markers is detected by Smart Measures, alerts are triggered in real time, enabling the system to instantly trigger a series of automated responses or for business to step in and remediate the problem.

The application of artificial intelligence or machine learning to the software is real ‘magic sauce’ and has taken the prediction and remediation of customer risk to a whole new level. It has also provided the software with its real edge in the market.

“Basically it has empowered our software to do what would not be humanly possible,” says Ms Dale

“AI enables Smart Measures to scroll through vast amounts of customer interaction data and very accurately predict which customers are at risk of churning and determine what action or treatment plans should be applied to the problem. The best is that this happens in real time which means that businesses can react instantly to a customer’s changing circumstances, rather than some time after the event when remediation may be too late and the damage is already done!

“Also rather than take a ‘one size fits all’ approach to managing risk, AI gives businesses the smarts to intervene on a case by case basis and apply treatment plans to suit the level and type of risk detected. This cuts out the annoyance for customers of being placed in a mass retention campaign that has little or no relevance to them or may cause further irritation.”

By automating the monitoring and treatment process, the application of AI/SmartMeasures has lessened the need for human intervention such as constantly checking dashboards or calling up clients when non-human responses would be more effective. “This allows for a smarter and more productive use of resources. However, this does not totally eliminate human intervention but which happens only when deemed absolutely necessary,” says Ms Dale.

The software falls into a rapidly emerging business practise area or discipline known as Customer Success Management. Subsequently, the product will be referred to as ‘customer success software’.

Unlike customer service, which takes a REACTIVE approach to managing customers and their problems, customer success is about businesses being PROACTIVE and dealing with customer problems and issues before they become insurmountable and the customer leaves.

“While so-called ‘customer success software’ has been about for some time, it has largely been used to measure the success of how customers use their software as a service (SaaS) purchases – if there is an opportunity to upsell or if customers are at risk of no longer purchasing. In essence, it has been an industry spawned to support businesses which sell SaaS or subscription based products.

“SmartMeasures has significantly broadened this approach to include non-SaaS software usage and apply Customer Success Management to the industry more broadly,” says Ms Dale.

For more media information contact:

Wendy Parker on 0422 694 503

Cost of customer churn too hard to ignore

Regardless of what you call it – defection, attrition, turnover, changing providers, you name it – customer churn is a painful reality doing business. Even the largest and most successful companies are not immune.

In Australia, our businesses on average lose between 6-8 percent of their customers each year, with our utilities and telecommunications sectors taking biggest beating with losses of between 20-25 percent.

To add further insult to injury, our energy retail market boasts one of the highest rates of market churn in the world, worst affected being Victoria which at last count was seeing one in four customers head for the door each year!

Much of this churn has been attributed to the liberalisation of energy retailing which has seen a succession of new entrants streaming into the market.

While competition at the best of times is good, constant switching between providers is significantly detrimental to profitability.

Australia’s health insurance sector – another group struggling under the yoke of unusually high customer churn – understands this all too well. It is seeing around 10 per cent of policy holders switching providers each year, which says health insurance industry consultant, Avnesh Ratnanesan, is putting $2 billion of revenue at risk on an annual basis.

While it is difficult, if not impossible, to determine what churn overall is costing Australian businesses, (these figures are not publicly available, in fact most businesses prefer not talking about customer attrition) best estimates put it at billions of dollars each year.

Sadly these losses, in the main, are viewed by most organisations as a part of doing business and something they have to live with!

The general consensus is that acquiring more customers and generating new business will in time balance out these unavoidable losses.

Regrettably, this thinking loses sight of the fact that it costs business 2-3 times more to acquire a new customer than retain an existing one (and in the case of the utilities sector, 6-7 times).

Businesses often forget that the cost of losing a customer is not just determined by the costs associated with recruiting replacement customers. There is also the loss of the ‘life-time value’ or the revenue the customer would ordinarily have brought in during their relationship with a business, not to mention the loss of revenue during on-boarding process.

These additional costs have the habit of just slipping under the corporate radar!

According to Sanjivrao Katakam, Principal Consultant – Energy & Utilities, Wipro, in India – who has worked extensively in the utilities sector around the world, including Australia, losing customers also has implications beyond loss of revenue.

This includes the loss of market share, a decline in brand image, not to mention the perilous threat of acquisition should a company be perceived to be haemorrhaging customers!

Tide is turning for customer retention

However, the good news is that despite the prevailing acceptance that customer attrition is part and parcel of doing business; the global tide is now turning.

More and more businesses are now no longer prepared to cop a financial belting and increasingly turning their attention to customer retention.

They are increasingly sharpening their focus on better understanding the key drivers of churn and how to step in and address an issue before it becomes a full-blown problem and a customer leaves.

Are you one of these more forward-thinking, progressive businesses? Do you believe churn is not something we should passively accept but rather something we should actively look at reducing?

Go to the Customer Churn Cost Savings Calculator to find out how much churn is costing your business.

Do we really care about keeping customers?

Apparently not! Over the past year or so I have been chatting to business managers and friends on the topic of being smarter about servicing customers … not just giving customers online self-service, but really putting in the effort into making life easier for them to stay our customers.

In these conversations, I have been genuinely surprised by the focus on customer acquisition and the apparent lack of concern for customer retention. In fact, the more I looked into the issue, the more I realised that Australian businesses overall view customer churn as a painful reality of business and something they have little control over.

Basically, it’s been put in the ‘too-hard basket’.

For starters, there’s no one person or department stepping up and taking responsibility for customer churn. On top of that there a huge misalignment between sales and service in businesses. Sales people are rewarded for the customers they bring on board, irrespective of whether they are a perfect fit or not and with total disregard for their longer term prospects.

Sadly it is often the service team that is left to pick up the pieces when the sales team gets it wrong and customers are sold the wrong product or service!

Growing global groundswell to managing retention

Despite the somewhat gloomy picture I have painted I am happy to report that there is a growing global groundswell to more effective customer retention.

This has resulted in the emergence of a brand new practice area, ‘customer success’, and is seeing businesses increasingly focussing their attention on customer retention and systems and processes aimed at keeping their customers happy.

Think of the cost to business and the unnecessary effort for customers in the current ‘acquire – churn – acquire’ way of doing business. According to Harvard Business Review “If you’re not convinced that retaining customers is so valuable, consider research done by Frederick Reichheld of Bain & Company (the inventor of the net promoter score) that shows increasing customer retention rates by 5% increases profits by 25% to 95%.”

“In many industries, hyper-competition has eroded traditional product and service advantages, making customer experience the new competitive battlefield,” said Jake Sorofman, research director at Gartner…. The reality is that focusing innovation on new products — and even new business models — is subject to shrinking periods of competitive advantage.”

The big question is: are Australian businesses embracing this new thinking?

Are we moving away from ploughing millions into new customer acquisition and truly getting behind improving customer retention through better customer experience. More importantly, are we doing a better job holding on to them than we have up until now?