Case Study

SmartMeasures helps ENGIE revolutionise arrears management

In a ground breaking initiative, energy retailer ENGIE is leveraging AI and behavioural science for early arrears prediction and intervention.

Overcoming the challenges associated with customer engagement and arrears management, this new strategy is aimed at reducing financial stress for ENGIE customers.

Traditional collections methods miss the chance to intervene early. By the time Retailer support teams get involved, accounts may have already fallen into significant arrears, and a lack of customer engagement can be challenging to manage. This cycle leads to more missed and delayed payments, which impacts both the customer and retailers.

Client

Retail energy

Joel Arnold

Head of Credit Risk & Collections

The challenge:

Early intervention and engagement

Joel Arnold, the Head of Credit Risk and Collections, and his team are focused on supporting customers in arrears by offering payment support, and maximising business performance and engagement. Early intervention to prevent debt arrears issues benefits everyone. Customers are better supported, the company has better business performance, and it creates a better customer experience.

Early intervention, however, is a difficult challenge, as Joel highlights, “Many customers are faced with complex financial priorities compounded and by rising costs of living, which can lead to delayed payments. To address this and proactively reach out before customers fall behind, we sought a more sophisticated approach. While our existing engagement strategies achieved results across various customer segments, we aimed to add a layer of intelligence. This is where implementing a predictive model became a natural next step.”

SmartMeasures is being used successfully to predict and prevent customer churn at ENGIE however, there was initial scepticism of SmartMeasures’ ability to meet the challenge of engaging customers early in the collections cycle.

“Having seen companies pitch predictive models for collections for many years but never seeing one that worked, I was initially sceptical. However, I am always up for trying something different and was curious to see how SmartMeasures would perform.”

As the pilot program for SmartMeasures progressed, Joel’s initial reservations dissipated.

The solution:

A data-driven and behavioural approach to arrears management

The pilot program for SmartMeasures was called ‘Predict and Engage’. By identifying customers at risk of falling into arrears in the future early in the collections cycle and engaging them, the program aimed to offer personalised support, including customised payment plans, potential grant opportunities, hardship assessment and other forms of assistance, preventing further arrears accumulation.

The objective of the pilot was to test the impact we could have on the early-stage arrears ($100 at 60 days) as well as late-stage arrears ($1,000 at 180 days).

The program went through three iterations to achieve the desired outcomes.

Stage 1

To test if SmartMeasures could predict and influence late-stage arrears.

The outcome Joel observed, “The pilot program could influence engagement in older stage arrears but the intervention was happening too late to influence better outcomes. Therefore it was necessary to predict customers before they fell too far behind.”

Stage 2

To test if SmartMeasures could predict very early arrears ($100 at 60 days).

“We found we could predict customer arrears very early in the collections cycle, however it required a sophisticated hierarchy of AI models to achieve the accuracy for the different customer arrears types (see callout box below). We were able to identify the customers that were likely to fall behind very early, when they had as little as $10 owing past 15 days.”, says Joel.

Stage 3

To test if SmartMeasures could influence customers who are not yet at the set early-stage arrears level ($100 at 60 days) as well as those who are already passed that limit.

“We found we could improve engagement and business performance for all customers who had not yet reached a set arrears level. We also found we could improve engagement for those who had passed that limit, however, it did not translate into a reduction in customer arrears levels”.

Joel observes, “It’s harder to assist customers when the amount owing becomes significant. And in a behavioural sense, customers are less likely to engage on reducing arrears if the amount becomes so large that they lose hope.”

SmartMeasures not only identified customers at risk of high arrears, but it also classified them into three category types, based on their individual circumstances and behavioural characteristics (see callout box). Crafting effective treatment messages for our different categories of customers requires a nuanced approach.

“With most of the activity in this program occurring so early in the collections cycle, it was able to be run in parallel with our normal collections activity”

Let’s get into the detail on …

Customer debt types

Yet to engage

These customers have not yet made a payment since becoming a customer. It was really important to identify these customers early to try and drive an earlier engagement.

Unexpected

This group are facing unexpected arrears. They may lack prior experience managing arrears and may feel overwhelmed due to unforeseen circumstances like job loss, illness, or increased living costs. This group often disengages. Recognising this unique situation, they’re approached with empathy and offered tailored supportive solutions. The treatment plans are geared towards support and education.

Needs assistance

These customers were observed to be in and out of assistance programs and would have extended periods of arrears. This indicated an awareness of what assistance is available however showed an apprehension to engage.

SmartMeasures was able to deliver personalised treatment plans that appealed to each arrears Type. The treatment messages were designed around the observed behaviour and to meet the support required for each Type.

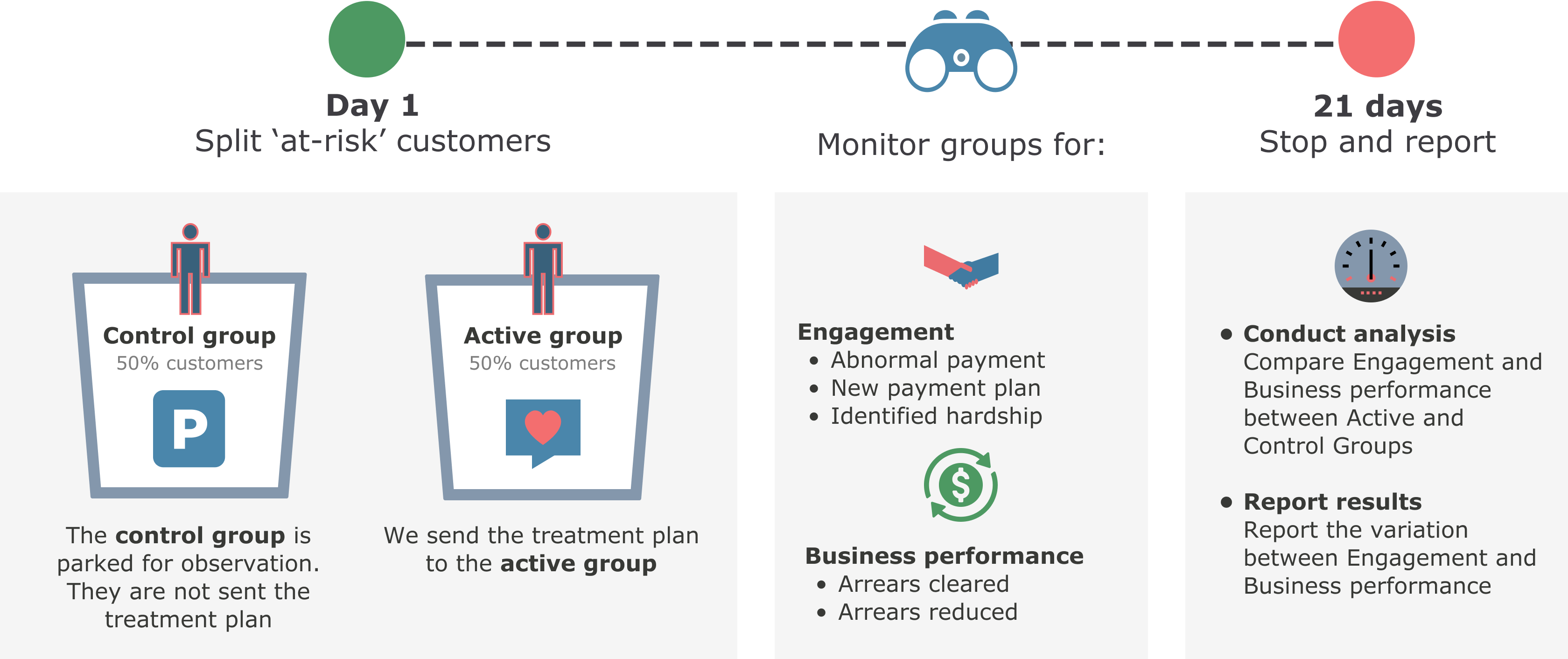

Rapid test and measure process

While the pilot program proved successful, it also emphasised the need for continuous improvement and optimisation. Joel emphasises the need for continuous improvement. “Optimising the program and testing new treatments is key,” he stresses. This commitment to rapid testing and measurement ensures ongoing adaptations for maximum impact.

“Rapid test and measure methodology goes beyond our standard champion challenger practices. We used control group testing to measure the impact of different treatment plans on the different customer types. We used control groups to measure both Engagement and Business Performance outcomes”.

The benefits:

Early success with personalised arrears treatment

During the pilot program, SmartMeasures tested 12 unique treatment plans. The treatment plans were designed by a behavioural specialist. Each treatment plan was tested against control groups to measure two things:

Customer engagement

Firstly, customer engagement. Joel says, “From my experience in many years of working in collections I understood that connecting and engaging with customers was the first step to solving their arrears. So we set out to measure improved customer engagement. If we can get the customer to contact us, we have a dedicated team who is proficient at helping the customer get their arrears under control.

Engagement was defined as the customer making an abnormal payment, signing up for a payment plan or being identified as hardship”.

Business performance

Secondly, we wanted to know if there was a change in business performance — how much sooner was arrears being reduced or cleared?

The pilot program yielded very promising results. “The pilot provided the facts needed to support implementing this solution longer term for customers who are not yet at the arrears target ($100 at 60 days). We were also able to verify that a hierarchy of AI models could maintain accuracy over time for each of the three customer arrears types,” explains Joel.

Outcomes

The tables below summarise the outcomes for customers in the early stages of arrears versus those who have reached $100 past 60 days due.

Not yet $100 at 60 days

Customer type |

Engagement |

Business performance |

|

|---|---|---|---|

| Arrears reduced | Arrears cleared | ||

| Yet to engage | 121% | 20.5% | 23.9% |

| Unexpected | 24% | 6.9% | 7.1% |

| Needs assistance | 6.9% | 5.5% | 1.9% |

Treatments are very effective for improving both engagement and business performance.

We were able to change behaviour when getting in early. In addition to bringing forward cash, this has the added benefit of reducing the volume of customers who will later fall into arrears.

At or above $100 at 60 days

Customer type |

Engagement |

Business performance |

|

|---|---|---|---|

| Arrears reduced | Arrears cleared | ||

| Yet to engage | 93% | 0.5% | 1.2% |

| Unexpected | 33% | 2.0% | 0.4% |

| Needs assistance | -2.4% | -1.0% | 0.7% |

For customers already At or above $100 at 60 days, engagement was effective but did not translate into business performance benefits.

Not everything we tested worked, but we did achieve an

ROI of $2.74 during the pilot

For every dollar spent on the pilot it returned $2.74 in cash flow

Looking forward: A brighter future for energy customers

“The SmartMeasures team worked as though they were part of the ENGIE team. They ran the solution as a managed service, including all operational aspects and reporting of activity and outcomes that could be shared with our normal business management teams. We were already using SmartMeasures for our Churn reduction program so we were familiar with how they would run things and were able to leave them to it”.

The ENGIE and SmartMeasures partnership signifies a significant step forward in arrears management within the energy retail sector. By leveraging predictive AI and behavioural science, the initiative promises to reduce financial stress for customers, improve business performance for ENGIE, and support our customer first approach.