SmartMeasures

Debt Reduction

Get in early to change payment behaviour and save customers from drowning in debt.

How SmartMeasures predicts customer debt before it happens

1.

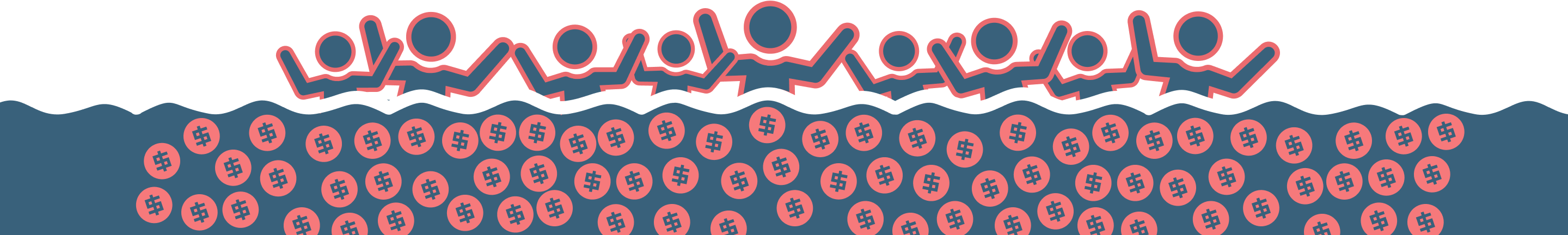

Gather data

Collect data from multiple sources across your business and anonymise personal information.

Messy data? No worries

SmartMeasures takes care of messy, missing and duplicated data issues.

2.

Predict & categorise

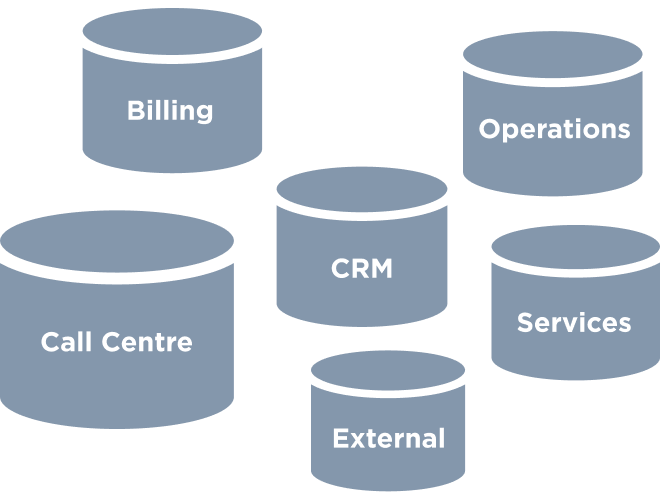

Every week the 4 prediction AI’s predict and categorise all customers that are at risk of falling into debt.

How we write treatment messages using Behavioural Science

- Craft bespoke messages that align to emotions for each defined customer type

- Frame all messages with supportive intention

- Reduce cognitive load via proactive messaging and simple calls to action

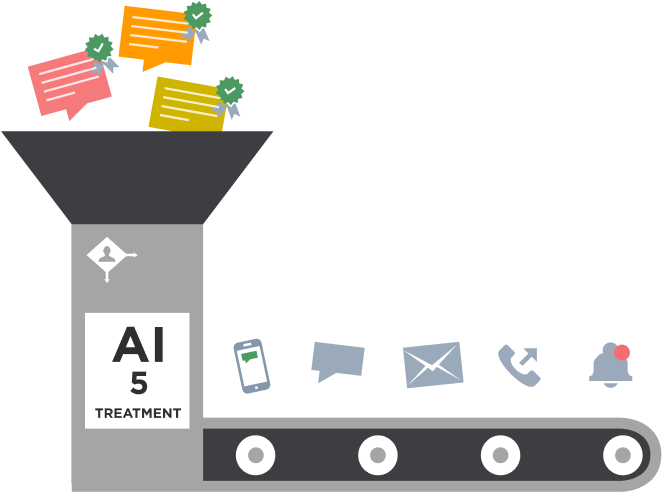

3.

Engage & collect

Proactively reach out to customers to shift payment behaviour in early stages of debt.

Treatment channels

Reach your customers the way they prefer whether it be SMS, chat, app notification, email, call or even a letter.

Our approach to debt

We focus on 3 distinct customer debt types and a different approach is needed to change the behaviour of each.

Uncover the Unexpected

These customers are new to debt, don’t engage and don’t realise help is available. Messages let them know we are here to help and offer support.

Help the Battlers

The ones that are doing it tough living hand to mouth and familiar to debt. Messages must acknowledge them and reinforce assistance available.

Expose the Unwilling

These people don’t engage and don’t intend to pay. Messages must be firm and communicate it’s not acceptable.

Outcomes

- Improved customer engagement

- Proactively support vulnerable customers

- Improve cashflow

- Know your debt customer types